Navigating the Digital Art Market: NFTs and Crypto Investment Guide

Understanding the Basics of NFTs

The digital art market has experienced a revolutionary shift with the introduction of Non-Fungible Tokens (NFTs). These unique digital assets have gained popularity due to their ability to provide proof of ownership and authenticity for digital art. Unlike cryptocurrencies such as Bitcoin, each NFT is distinct and cannot be exchanged on a one-to-one basis, making them ideal for representing digital artworks.

NFTs utilize blockchain technology, which ensures that the ownership history of each piece is securely recorded and easily verifiable. This transparency has attracted artists and collectors alike, creating a thriving marketplace where digital art can be bought, sold, and traded.

Investing in NFTs: What to Consider

Investing in NFTs requires a different mindset compared to traditional art or stocks. Here are a few key considerations:

- Rarity and Uniqueness: The value of an NFT often depends on its rarity. When investing, look for pieces that are not only unique but also have a limited supply.

- Artist Reputation: Just like in the physical art world, the reputation of the artist can greatly influence the value of their digital creations. Research the artist’s background and previous work before making a purchase.

- Market Trends: The NFT market is highly volatile, with trends changing rapidly. Stay informed about current market dynamics to make more informed investment decisions.

The Role of Cryptocurrencies in NFT Transactions

Cryptocurrencies play a crucial role in the purchase and sale of NFTs. Most NFT marketplaces operate on blockchain platforms like Ethereum, where transactions are conducted using cryptocurrencies. Understanding how cryptocurrencies work is essential for anyone looking to enter the NFT market.

When buying an NFT, you will need a digital wallet that supports cryptocurrency transactions. The most commonly used currency for NFT transactions is Ether (ETH), but some platforms may accept other coins as well. Familiarize yourself with the processes of buying, storing, and managing cryptocurrencies to ensure smooth transactions.

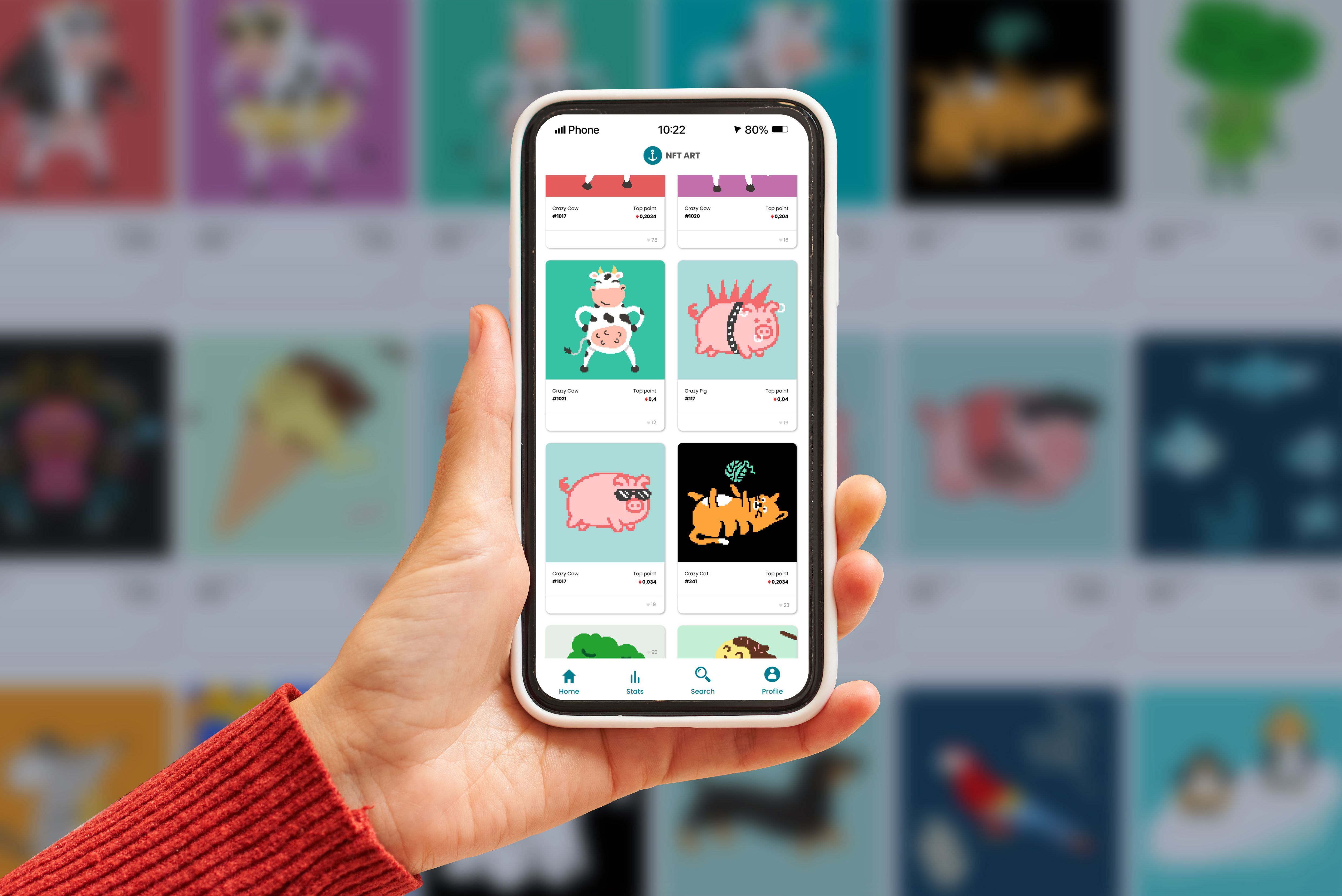

Navigating NFT Marketplaces

NFT marketplaces are platforms where artists can list their creations and buyers can browse and purchase them. Popular marketplaces include OpenSea, Rarible, and Foundation. Each platform offers different features, such as auction-style sales, fixed-price listings, and artist verification processes.

When choosing a marketplace, consider factors like user interface, transaction fees, and community presence. Participating in these platforms also allows you to engage with other collectors and artists, providing insights and opportunities within the digital art community.

Risks and Challenges in the Digital Art Market

While the NFT market presents exciting opportunities, it also comes with inherent risks. One major challenge is the potential for intellectual property disputes. As digital art can be easily reproduced, ensuring that you are purchasing from the legitimate creator is vital.

Additionally, the volatility of cryptocurrency values can affect NFT prices. Fluctuations in currency value might lead to unexpected gains or losses, impacting your overall investment strategy. It's important to stay updated on both NFT market trends and cryptocurrency performance.

The Future of NFTs and Digital Art Investment

The future of NFTs and digital art investment holds immense potential. As technology continues to evolve, new applications for NFTs could emerge beyond art, including music, virtual real estate, and even identity verification.

For investors and enthusiasts alike, staying informed about technological advancements and market trends will be key to navigating this dynamic landscape. As more artists explore digital mediums and platforms expand their offerings, the digital art market is poised for continued growth and innovation.